.jpg)

Links: Overview | Reg. Fee | Prerequisites | Topics | Materials | Speakers | Comments

About the Advanced Bankruptcy Conference

The purpose of the NorthLegal Advanced Bankruptcy Conference is to help those who already have a firm understanding of consumer bankruptcy law to move to "the next level," both by exploring more complex rules and by applying and testing their knowledge against real life situations.

The Advanced Bankruptcy Conference will differ from the main NorthLegal Bankruptcy Conference in that—

- Little, if any, time will be spent during the Advanced Bankruptcy Conference on "introductory" type issues.

- Although many of the same topics will be covered during both programs, the focus during the Advanced Bankruptcy Conference will be on advanced aspects of those topics. Many subjects (such as means testing, preferences, and analysis of actual Chapter 13 plans) will also be covered in greater depth than is possible during the main Bankruptcy Conference.

- There will be greater emphasis on group participation using hypothetical situations and test cases.

- At least one guest speaker is planned. (Because attorney schedules are subject to change depending on litigation calendars and emergencies, guest speaker participation is tentative.)

NOTE: This program is still evolving. Check back for information about this program and about how it will compare to the NorthLegal Bankruptcy Conference.

Schedule

| Monday (9/14) | 9:00 a.m. to 4:30 p.m. | Lunch included |

| Tuesday (9/15) | 9:00 a.m. to 4:30 p.m. | Lunch on your own |

| Wednesday (9/16) | 9:00 a.m. to 4:30 p.m. | Lunch on your own |

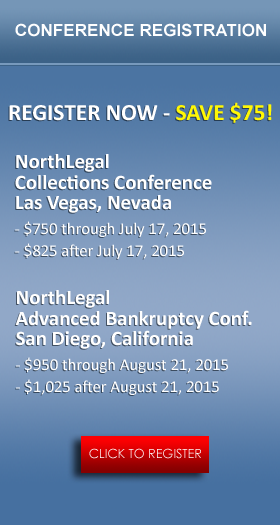

Until July 26, 2015, the early registration fee is $875.00. From July 27 until August 21, 2015, the registration fee will be $950.00. Registrations received after August 21 will be accepted at the rate of $1,025.00.

To register, click here.

The NorthLegal Advanced Bankruptcy Conference was developed for those who have already attended the main NorthLegal Bankruptcy Conference on multiple occasions and who are ready for more detailed information. Attendance at the Bankruptcy Conference first, at least once (but preferably more than once) is strongly encouraged even for those with significant bankruptcy experience. Sometimes those who have learned "on the job" find they have been taught errors or have not be taught key basic rules. The NorthLegal Bankruptcy Conference will help with that and will provide a firm foundation upon which the Advanced Bankruptcy Conference can build.

Nevertheless, those with at least five years of recent experience handling consumer bankruptcy matters in a financial institution, law office, or trustee's office environment are also welcome to attend the NorthLegal Advanced Bankruptcy Conference.

All participants must be employees of consumer lending institutions such as banks, credit unions or automobile finance lenders, or financial institution agents such as attorneys or collection agencies.

The Advanced Bankruptcy Conference is not intended to present totally different information from the main NorthLegal Bankruptcy Conference. The main Bankruptcy Conference presents advanced bankruptcy material too. However, while the Bankruptcy Conference begins on the first day at a very basic level and does not get to advanced material until the second or third day, the Advanced Conference assumes participants have a strong combination of training and hands-on experience and builds on that foundation. General subjects such as the automatic stay and the discharge injunction are still discussed, but the emphasis is on more challenging application of those rules.

A strict scheduled "agenda" is not available in advance of the program, because the speaker believes participants benefit from the ability to cover some topics as they arise. However, the following topics, among others, will be covered in detail during the three-and-a-half day conference:

» Debtor Protection During and After Bankruptcy

- In-depth analysis of the "automatic stay," the "codebtor stay" and the "discharge injunction."

- When each begins and ends (including the various times the automatic stay automatically ends).

- What the purpose is of each, and why that's important.

- What each prohibits, and how courts interpret those prohibitions.

- When the court will grant "relief" from the stay or injunction.

» Handling Chapter 7 Bankruptcy Cases

- The importance of means testing, and how to perform the calculations

- Protecting security interests

- Adequate protection

- Obtaining and documenting reaffirmation agreements

- Redemption

- Surrender

- Collecting from coborrowers

- Exceptions to discharge

- Education loans

- Tax payment loans

- Fraudulent loans

- Preventing discharge

- Finding and collecting from assets

- Exemptions

» Handling Chapter 13 Bankruptcy Cases

- Reviewing Chapter 13 Plans

- Protecting security interests

- Adequate protection

- Valuation and cramdown

- Creditor's right to interest during the bankruptcy.

- Special rules relating to mortgages and other real property loans

- Collecting from coborrowers

- Exceptions to Discharge

- Education loans

- Tax payment loans

- Fraudulent loans

- Rights of Unsecured Creditors

- Best Effort Test

- Feasibility Test

- Liquidation Test

- Good Faith Test

- Eligibility for Chapter 13

» Advanced and Controversial Issues

- Offsetting and Enforcing Liens on Shares

- Payroll Deduction and Automated Payments

- Denial of Services

- Cross Collateral Clauses

- Credit Reporting of Bankruptcy Obligations

- Privacy Issues in Bankruptcy

Each participant will receive extensive handout materials that outline, discuss, and analyze bankruptcy law as it pertains to consumer lending. Although these course materials are not intended to serve as a "stand alone book" (in fact, they are not sold to those who do not attend the conference), many conference participants have told us they use the course materials as a reference guide to assist them in handling cases throughout the year.

Speakers

Speakers

The primary speaker for the conference is Eric North. Eric is a practicing

attorney who has devoted his legal practice to representing the interests of

consumer lending institutions for more than twenty-five years.

Prior to beginning the practice of law, Eric worked within various financial

institutions in lending, collections, and operations departments, and managed

several of those institutions. This experience allows Eric to bring practical,

as well as "legal" information

to those who attend his programs.

In addition to practicing law, Eric dedicates a significant portion of his time

each year to the training of hundreds of consumer credit professionals throughout

the United States through local programs presented on behalf of dozens of state and national trade associations, through monthly NorthLegal Webinars, and through

the annual NorthLegal Bankruptcy Conference.

It is anticipated there may be one or more guest speakers at the conference, although that is not for certain. Further information will be posted here as it becomes available.